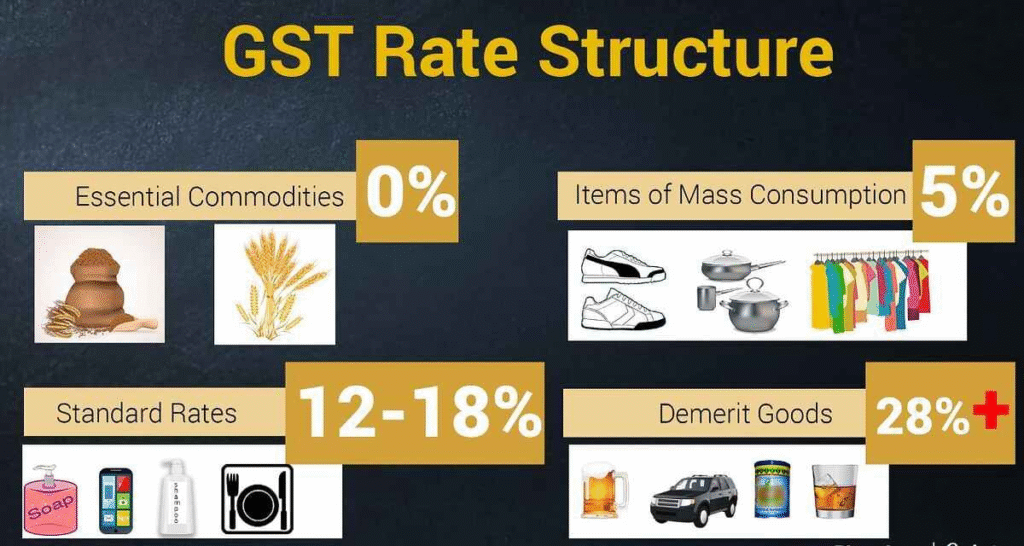

GST 2025 Simplified: The Goods and Services Tax (GST) Council has announced a major restructuring of India’s indirect tax system, effective September 22. The earlier four-tier structure of 5%, 12%, 18% and 28% has been rationalised into two primary slabs — 5% and 18%. Additionally, a 0% tax bracket for essentials and a 40% slab for luxury or sin goods have been introduced.

This move is expected to provide relief to lower and middle-income groups, while placing heavier levies on luxury and harmful products.

0% GST Slab: Essentials Get Cheaper

Items exempted from GST under the new structure include:

- Stationery items: exercise books, notebooks, erasers, pencils, sharpeners, crayons, pastels, maps, charts, and globes.

- Food items: Ultra-High Temperature (UHT) milk, condensed milk, butter, ghee, dairy spreads, cheese, brazil nuts, almonds, pistachios, dates, figs, dried mangoes, and citrus fruits.

- Life-saving medicines: 33 critical drugs such as Asciminib, Mepolizumab, Daratumumab, Teclistamab, Amivantamab, and Alectinib.

This reduction directly benefits households and patients, easing the burden on day-to-day living and healthcare.

5% GST Slab: Affordable Food and Health Products

The 5% category includes:

- Food items like pasta, noodles, cornflakes, pastry, and cakes.

- Dry fruit varieties such as almonds, pistachios, dates, figs, and mangoes.

- Healthcare products like thermometers, medical-grade oxygen, diagnostic kits, reagents, glucometers, and test strips.

- Daily-use products: face powder, hair oil, shampoo, toothpaste, tooth powder, and shaving cream.

This adjustment ensures wider affordability of essentials and healthcare materials.

18% GST Slab: Standard Goods and Services

The 18% tax bracket now covers a wide range of items, including vehicles, electronics, and textiles.

Vehicles:

- Petrol and petrol-hybrid LPG, CNG cars (not exceeding 1200 cc & 4000 mm).

- Diesel & diesel-hybrid cars (not exceeding 1500 cc & 4000 mm).

- Three-wheeled vehicles and motorcycles (350 cc and below).

- Motor vehicles for the transport of goods.

Electronics:

- Air conditioners.

- Televisions above 32 inches.

- Monitors and projectors.

Industrial Goods:

- Cement types: Portland, aluminous, slag, super sulphate.

- Coal, lignite, peat and their manufactured fuels.

- Biodiesel (except when supplied to Oil Marketing Companies).

- Pneumatic tyres, chemical wood pulp, kraft paper, paperboard varieties, greaseproof and composite papers.

Also Read: GST Benefit for Customers: Amul Reduces Prices on 700 Products

Textiles and Apparel:

- Knitted or crocheted clothing accessories above ₹2,500 per piece.

- Non-knitted apparel above ₹2,500 per piece.

- Made-up textile articles exceeding ₹2,500 per piece.

Appliances:

- Dishwashing machines (household and industrial).

- Air-conditioning machines with temperature and humidity control.

This restructured 18% slab brings many items down from the earlier 28%, especially electronics and vehicles, giving relief to consumers.

Full GST Rate Quick Reference

| Type of Item | Previous Rate | New Rate

| Food staples | 12–18% | 5%

| Electronics | 28% | 18%

| Medicines & insurance | 5–18% | 0–5%

| Sugary drinks | 28%+cess | 40%

| Luxury cars/bikes | 28%+cess | 40%

40% GST Slab: Luxury and Sin Goods

The highest slab of 40% applies to items categorised as luxury or harmful to health.

Tobacco and Related Products:

- Pan masala.

- Cigars, cheroots, cigarillos, cigarettes, manufactured tobacco substitutes.

- Tobacco extracts, essences, reconstituted tobacco.

- Products containing tobacco or nicotine intended for inhalation without combustion.

Beverages:

- Aerated waters containing sugar or flavouring.

- Carbonated beverages with fruit juice.

- Caffeinated drinks and other non-alcoholic flavoured beverages.

Luxury Vehicles and Goods:

- Motor cars above 1200 cc (petrol) and 1500 cc (diesel), exceeding 4000 mm length.

- Motorcycles exceeding 350 cc engine capacity.

- Yachts, private vessels, and personal-use aircraft.

Others:

- Revolvers, pistols, smoking pipes, and related accessories.

- Specified actionable claims involving betting, casinos, gambling, horse racing, lottery, or online money gaming.

This category ensures that high-end luxury and harmful goods face stricter taxation, discouraging over-consumption and increasing government revenue.

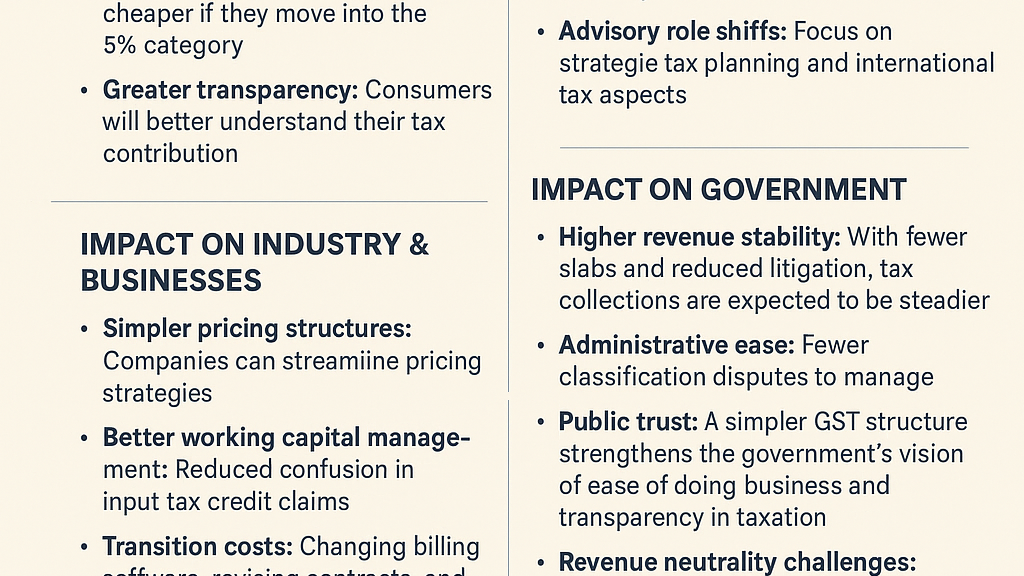

Impact of the New GST Structure

The simplified GST structure benefits common households, students, and patients by making essentials more affordable. It reduces the burden on middle-class families through lower taxes on everyday products and electronics, while maintaining strict taxation on luxury items and sin goods.

This balanced approach is expected to stabilise inflationary pressure, encourage fair consumption, and improve compliance in the GST regime.

A Defining Shift in India’s Tax System

India’s GST reform marks a decisive shift toward a simpler, more inclusive taxation model. By reducing the four earlier slabs to two practical ones, along with a zero-tax category and a high-value 40% slab, the government has struck a balance between affordability and accountability.

Essentials like food, stationery, and life-saving drugs have been relieved of tax, directly impacting daily lives. Meanwhile, luxury items, sin goods, and high-end vehicles bear the cost of heavy taxation. This policy reflects a people-first approach while ensuring sustainable revenue for the nation.

Divine Relief and Social Welfare: Saint Rampal Ji Maharaj’s Unique Contribution

Just as the government uses GST reforms to provide financial relief and ease the burden on citizens, Tatvdarshi Saint Rampal Ji Maharaj Ji is offering unparalleled support to the needy through the Annapurna Muhim initiative.

Under this program, He provides food, clothing, education, healthcare, and housing to those in need, while also offering aid to villages affected by floods. So far, the total assistance provided by Saint Rampal Ji Maharaj Ji has exceeded ₹3 crore, reaching numerous villages not only in Haryana but also in Punjab, Uttarakhand, Delhi, and other regions.

For more details about the ongoing humanitarian and spiritual initiatives, visit www.jagatgururampalji.org.

FAQs on New GST Rates 2025

1. What are the new GST slabs effective from September 22, 2025?

The new GST structure has two main slabs — 5% and 18%, with a 0% slab for essentials and a 40% slab for luxury or sin goods. This simplification replaces the earlier four-tier system of 5%, 12%, 18%, and 28%.

2. Which items are included in the 0% GST category?

Essential items like stationery (exercise books, pencils, crayons), UHT milk, daily food items (butter, ghee, cheese, dry fruits), and 33 life-saving medicines are exempt from GST.

3. What goods fall under the 18% GST slab?

The 18% slab covers vehicles (small cars, three-wheelers, motorcycles ≤350cc), electronics (air conditioners, TVs >32 inches, monitors, projectors), cement types, coal, and textile items above ₹2,500 per piece.

4. Which items are taxed at 40% GST?

Luxury and sin goods are taxed at 40%, including pan masala, tobacco products, aerated and caffeinated drinks, luxury cars, motorcycles >350cc, yachts, private vessels, and personal-use aircraft.

5. How will the new GST structure affect consumers?

The reform makes daily essentials, healthcare products, and household items more affordable, while luxury items and sin goods face higher taxation. This balanced approach benefits lower- and middle-income groups, encourages fair consumption, and supports government revenue.