India’s provident fund system is on the brink of its most significant transformation in years. The Employees’ Provident Fund Organisation is preparing to roll out EPFO 3.0, a comprehensive technology overhaul that promises a new digital portal, UPI-based PF withdrawals, AI-powered regional language support and bank-like services for members.

Reported by the Indian Express citing senior government officials, the move aims to modernise EPFO’s operations as its coverage expands under Labour Codes. With nearly eight crore active members and a massive retirement corpus, EPFO 3.0 is designed to make services faster, simpler and accessible nationwide.

Key Takeaways on EPFO 3.0: What the New PF System Means for Members

- EPFO 3.0 marks a full-scale digital reset with a new portal and backend software replacing incremental upgrades.

- Core banking–style architecture will allow centralised, location-independent services similar to banks.

- UPI-based PF withdrawals via BHIM are planned, with balance visibility and an initial ₹25,000 transaction cap.

- AI-powered language tools like Bhashini will help members access services in vernacular languages.

- EPFO’s role is set to expand to unorganised workers following Labour Codes implementation.

- EPFO 2.0 reforms are nearing completion, clearing the path for the next phase.

What Is EPFO 3.0 and Why It Matters

EPFO 3.0 is being positioned as a complete transformation of the technology backbone of the Employees’ Provident Fund Organisation. Instead of continuing with patchwork system upgrades, the retirement fund body is moving towards a core banking-style model, similar to the systems used by commercial banks to manage high transaction volumes in real time.

According to officials quoted by the Indian Express, EPFO 3.0 will involve new architecture, new backend software and a completely revamped portal. The objective is to build a system capable of handling future growth over the next decade, especially as the organisation’s responsibilities expand beyond the organised workforce.

For members, this change could mean fewer delays, smoother claims processing and faster grievance redressal, regardless of where their account is registered.

Why EPFO Is Shifting to a Core Banking System

The timing of EPFO 3.0 is closely linked to the implementation of new Labour Codes. Once these codes are enforced, EPFO’s coverage is expected to extend significantly to unorganised sector workers, bringing a much larger population under social security.

Officials have also indicated that EPFO may be entrusted with managing a separate social security fund for unorganised workers, distinct from the fund proposed for gig and platform workers.

At present, EPFO manages a retirement corpus of around ₹28 lakh crore and serves nearly 8 crore active members. As volumes grow and responsibilities increase, a core banking solution is seen as critical to ensure the system does not slow down under pressure.

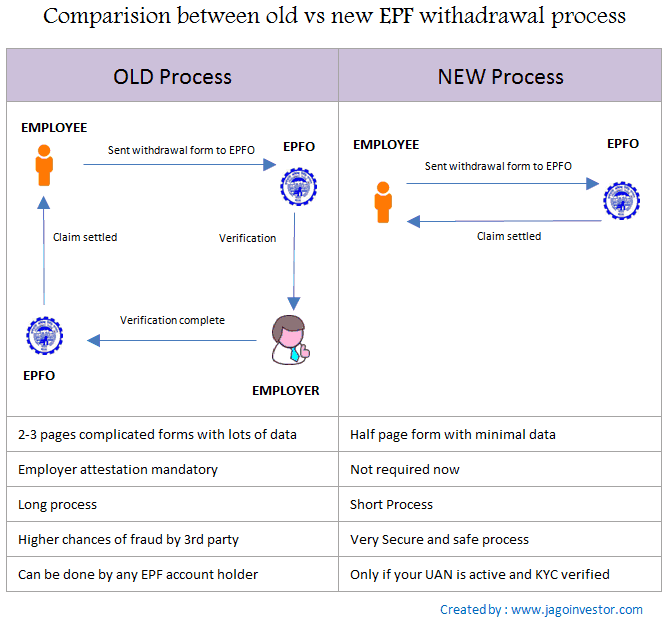

UPI-Based EPF Withdrawals: What Members Should Know

One of the most visible and much-awaited features linked to EPFO’s technology overhaul is the UPI-based PF withdrawal facility. EPFO is working on enabling members to withdraw funds using the BHIM app.

Under the proposed system, members will be able to:

- View their total EPF balance

- See the eligible amount for withdrawal

- Clearly identify the mandatory 25% minimum balance

Internal discussions suggest that initial UPI withdrawals may be capped at ₹25,000 per transaction. This facility follows EPFO’s decision to streamline withdrawal norms, reducing categories from 13 to three: essential needs, housing needs and special circumstances.

EPFO 3.0 Implementation Timeline: What We Know So Far

While EPFO 3.0 is being prepared, the organisation is in the final stages of completing its current upgrade phase, known as EPFO 2.0. Officials have indicated that only three modules—pension, claims and annual accounts—are pending and are expected to go live soon.

Also Read: EPFO Reforms: Passbook Lite, Annexure K & Faster Settlements

A senior official quoted by the Indian Express said the remaining work is a matter of “1–2 months”, after which the transition to the next phase can accelerate. The UPI-linked withdrawal feature is expected to be rolled out by April, marking a key milestone before EPFO 3.0 gains momentum.

AI-Powered Language Support to Reach Members Nationwide

Another significant feature of EPFO 3.0 is the use of AI-based translation tools to communicate with members in regional languages. Officials have confirmed plans to use platforms like Bhashini, developed by the Ministry of Electronics and Information Technology.

This move aims to make EPFO services more inclusive, especially for members who struggle with English-only digital interfaces. By providing information in vernacular languages, EPFO hopes to improve awareness, reduce errors and make digital services more accessible across the country.

Tender Process and Technology Partners

To build and operate the new digital platform, EPFO is preparing to float a tender for selecting an agency that will implement, maintain and manage the system across its social security schemes. Officials have confirmed that the financial vetting process is underway, and the tender is expected to be floated soon.

Last year, EPFO had already shortlisted Wipro, Infosys and TCS after issuing an Expression of Interest, highlighting the scale and complexity of the project.

Where EPFO 2.0 Stands Today

Even as EPFO 3.0 takes shape, several reforms under EPFO 2.0 have already been rolled out. These include a revamped Electronic Challan-cum-Return (ECR) system and an internal user management module for task allocation.

EPFO has also enabled self-correction of personal details without employer approval. Members can now update details such as name, date of birth, marital status and employment dates directly. Between January and December 2025, 32.23 lakh profile corrections were processed through this facility.

A Spiritual Perspective on Financial Security: Insights from the Unique Knowledge of Saint Rampal Ji Maharaj

While reforms like EPFO 3.0 focus on strengthening financial security through technology and policy, Saint Rampal Ji Maharaj’s unique spiritual knowledge draws attention to an equally important dimension of human life — true and permanent security. According to His teachings, material arrangements such as savings, pensions or social security schemes can support physical needs but cannot remove the root causes of sorrow, fear and uncertainty.

Saint Rampal Ji Maharaj emphasizes that complete peace and lasting safety are attainable only through true spiritual knowledge (Tatvagyan), correct worship and devotion as described in sacred scriptures. From this perspective, systems like EPFO ensure worldly stability, while spiritual knowledge provides inner assurance and ultimate liberation, completing the balance between material well-being and spiritual fulfillment.

Building a Bank-Like PF System for the Future

With EPFO 3.0, the organisation is clearly aiming to move away from slow, office-dependent processes towards a system that works more like a modern bank. Faster services, language-friendly communication and centralised operations are at the heart of this transformation.

As India’s workforce evolves and more workers enter the social security net, EPFO 3.0 is being designed to ensure the provident fund system remains robust, scalable and accessible for decades to come.

FAQs on EPFO 3.0: New Portal, UPI Withdrawals and PF Reforms Explained

1. What is EPFO 3.0 and why is it being introduced?

EPFO 3.0 is a major technology overhaul of the Employees’ Provident Fund Organisation, introducing a new portal, core banking system and AI tools to improve PF services nationwide.

2. How will EPFO 3.0 change PF services for members?

EPFO 3.0 will enable centralised, bank-like services, faster claims, location-independent grievance handling and easier access to provident fund facilities for organised and unorganised workers.

3. Will EPF withdrawals be possible through UPI under EPFO 3.0?

Yes, EPFO plans UPI-based PF withdrawals via the BHIM app, showing eligible balance and 25% minimum balance, with initial withdrawals likely capped at ₹25,000 per transaction.

4. What role will AI and regional languages play in EPFO 3.0?

EPFO 3.0 will use AI-powered tools like Bhashini to provide PF-related information and services in vernacular languages, improving accessibility for non-English-speaking members.

5. When is EPFO 3.0 expected to be implemented?

EPFO 3.0 rollout will follow the completion of EPFO 2.0 modules, with key features like UPI withdrawals expected by April and further implementation progressing in phases.