PAN-Aadhaar Linking 2026: The Income Tax Department has once again stressed the final date for connecting the Permanent Account Number (PAN) with Aadhaar in a very important note to the taxpayers of India. According to the most recent instruction, any PAN card that has not been linked with Aadhaar by the end of December 2025 will no longer be valid starting January 1, 2026. This decision is not only the government’s attempt to modernize tax collection and reduce tax fraud but also a step toward a more organized and less corrupt tax system.

Image Source: paisabazar.com

Key Points on “PAN card inactive from January 2026”

- Deadline: Link PAN with Aadhaar by December 31, 2025.

- Inactivation Date: PAN becomes inoperative from January 1, 2026.

- Legal Basis: Mandatory under Section 139AA of the Income Tax Act.

- Who Must Link: Individuals issued PAN before July 1, 2017, and eligible for Aadhaar.

- Major Impact: No ITR filing, blocked bank services, stalled investments, and no tax refunds.

- Late Fee: ₹1,000 applicable for linking after the earlier deadline.

- Multiple Methods: Linking available via online portal, SMS, and PAN service centers.

Why PAN-Aadhaar Linking Is Mandatory

The requirement to connect PAN with Aadhaar comes from Section 139AA of the Income Tax Act, which was passed by the government to eradicate duplicate and fake PANs. The Central Board of Direct Taxes (CBDT) has made it clear that persons who were given PAN before July 1, 2017, and who can get an Aadhaar number, must do the linking.

Also Read: Mandatory PAN-Aadhaar Linking: Complete Update by December 31, 2025 or Lose PAN Access

This project is meant for increasing the openness of financial dealings and also making it certain that the tax system has one single identity for each person.

Consequences of Not Linking PAN with Aadhaar

Failing to link PAN with Aadhaar by the stipulated deadline can lead to significant disruptions in financial and legal activities. Here are the key implications:

- Inoperative PAN: From January 1, 2026, unlinked PANs will be rendered inoperative.

- Income Tax Filing: Individuals will not be able to file their Income Tax Returns (ITR) using an inoperative PAN.

- Refunds and TDS: Tax refunds will not be processed, and Tax Deducted at Source (TDS) credits may not reflect in the taxpayer’s account.

- Banking and Investments: PAN is essential for opening bank accounts, investing in mutual funds, and conducting high-value transactions. An inoperative PAN can block these activities.

- Property Transactions: Buying or selling property, which requires PAN verification, may be delayed or denied.

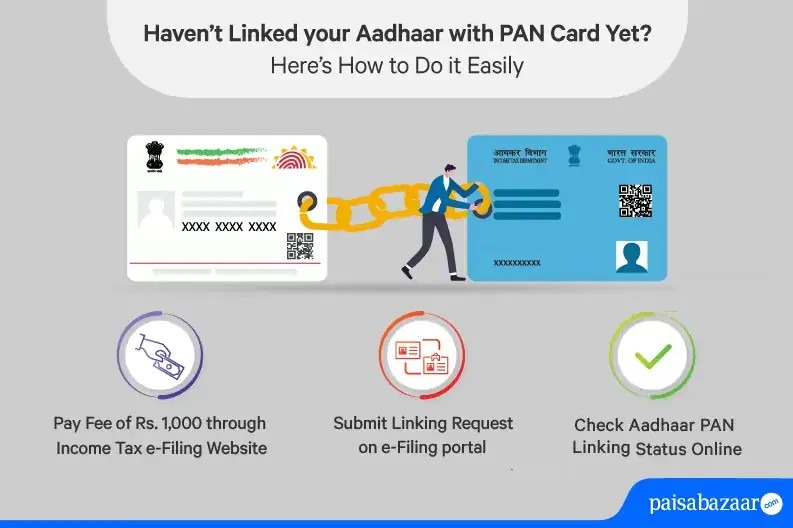

How to Link PAN with Aadhaar

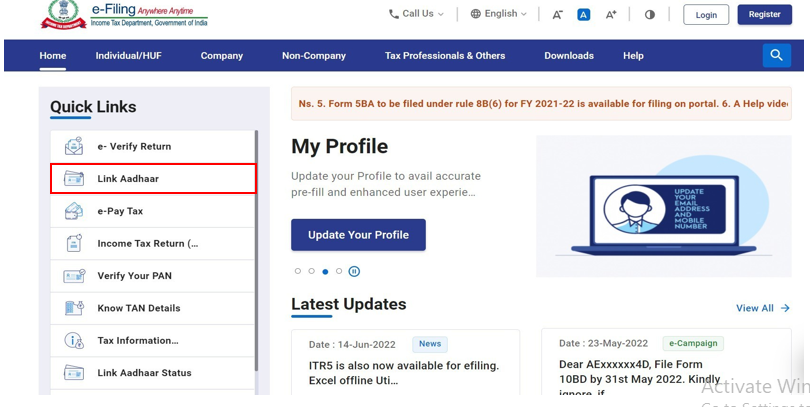

Image Source: Income Tax Department

The government has provided multiple channels for taxpayers to complete the linking process:

1. Online via Income Tax Portal:

- Visit the Income Tax e-filing website

- Click on “Link Aadhaar” under the Quick Links section

- Enter your PAN, Aadhaar number, and mobile number

- Submit the OTP received on your mobile

2. SMS Method:

- Send an SMS in the format: UIDPAN<space><12-digitsaAadhaar><space><10-digit PAN> to 567678 or 56161

3. Offline Mode:

- Visit PAN service centers (NSDL or UTIITSL) with the required documents

A late fee of ₹1,000 is applicable for linking PAN with Aadhaar after the original deadline of June 30, 2023.

How to Check PAN-Aadhaar Link Status

Image Source: m.Stock

To verify if your PAN is already linked:

- Go to the Income Tax e-filing portal

- Click on “Link Aadhaar Status”

- Enter your PAN and Aadhaar number to check the current status

SEO-Optimized Keywords to Track

To stay informed and help others find this information online, here are some trending search terms:

– “PAN Aadhaar link last date 2025”

– “PAN card inactive from January 2026”

– “How to link PAN with Aadhaar online”

– “PAN Aadhaar linking penalty”

– “PAN Aadhaar link status check”

Act Now to Avoid Financial Disruptions

As the due date is nearing, taxpayers are advised to take action without delay. The government has straightened out that no more time extensions will be allowed. Connecting your PAN with Aadhaar is not just a mandatory procedure; it is a necessity for keeping financial services uninterrupted and complying with tax regulations.

Sources Used:

- Times Bull – PAN Card Will Become Invalid on January 1

- Income Tax Department – Aadhaar PAN Linking

The Ultimate Connection That Saves the Soul

Just like linking your PAN to Aadhaar keeps you safe from financial troubles, similarly, the connection of your life to the True Saint and the way of true worship saves you from the biggest troubles of life, endless birth, death and the 84 lakh life form’s cycle. It is only the connection with the Tatvdarshi Saint’s way that can lead one to liberation from the sufferings of Kaal-controlled 21 universes.

This Tatvdarshi Saint is Sant Rampal Ji Maharaj, who always offers the correct way of communicating with God precisely as our holy books suggest. A practitioner’s acceptance of and adherence to this divine method elevates him to Satlok; the eternal, indestructible abode where no sorrow, sickness, fear or death exists. Such a place is the never-ending home of our Supreme Father, Kabir Parmeshwar, where happiness is forever and life never ends.

Just as quick linking of PAN to Aadhaar shields your financial world, the acceptance of spiritual guidance from Sant Rampal Ji Maharaj shields your eternal world.

This is just a tiny glimpse of the divine knowledge of Sant Rampal Ji Maharaj.

To hear the complete spiritual wisdom, download the Sant Rampal Ji Maharaj App.

FAQs on PAN-Aadhaar Linking (2026)

1. What is the last date to link PAN with Aadhaar in 2025?

Ans. The final deadline to link your PAN with Aadhaar is December 31, 2025. If not linked by this date, your PAN will become inoperative from January 1, 2026.

2. What happens if my PAN becomes inoperative after January 1, 2026?

Ans. If your PAN becomes inactive, you will be unable to file ITR, receive refunds, open bank accounts, make investments, or carry out high-value transactions that require PAN verification.

3. Who is required to link PAN with Aadhaar?

Ans. All individuals who were allotted a PAN before July 1, 2017, and who are eligible to obtain Aadhaar, must complete the PAN-Aadhaar linking as per Section 139AA of the Income Tax Act.

4. What is the penalty for linking PAN with Aadhaar after the previous deadline?

Ans. A late fee of ₹1,000 is applicable if you link your PAN and Aadhaar after the earlier deadline of June 30, 2023.

5. How can I check if my PAN is already linked with Aadhaar?

Ans. You can check your link status by visiting the Income Tax e-filing portal, selecting “Link Aadhaar Status,” and entering your PAN and Aadhaar number.